How to Connect TradingView?

Aug 11, 2022

Getting started

-

Homoro.com is online-service which gives ability to connect TradingView with Binance and convert TradingView alerts to orders on cryptocurrency exchange.

For start using needed:

- Get Homoro User Key

- Binance [ or Kucoin ] API keys

- TradingView account

Get Homoro User Key

-

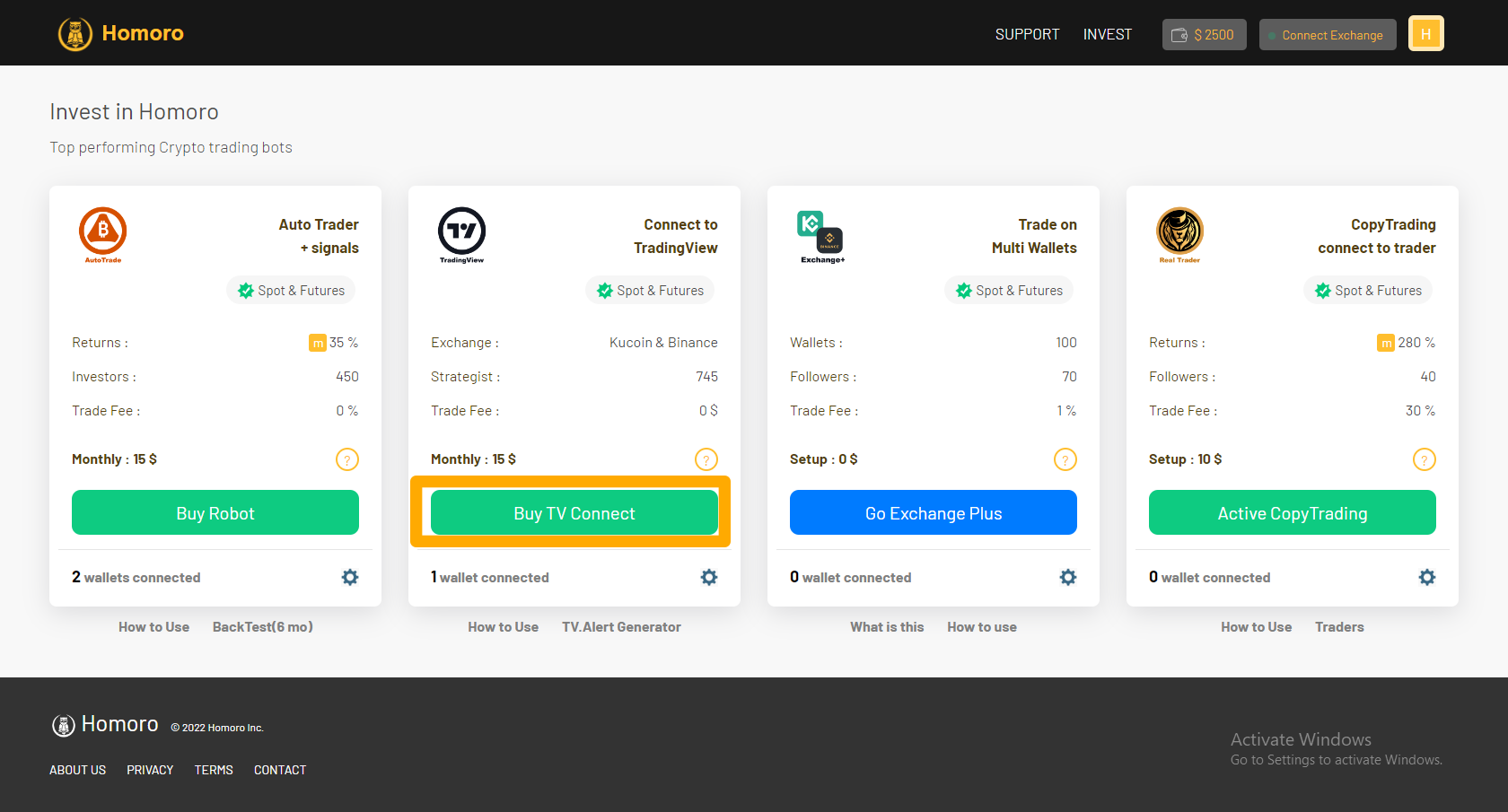

Step #1 [ Get Homoro UserKey] :

After Add Wallet in Homoro, you can connect wallet(s) to tradingview in homoro.

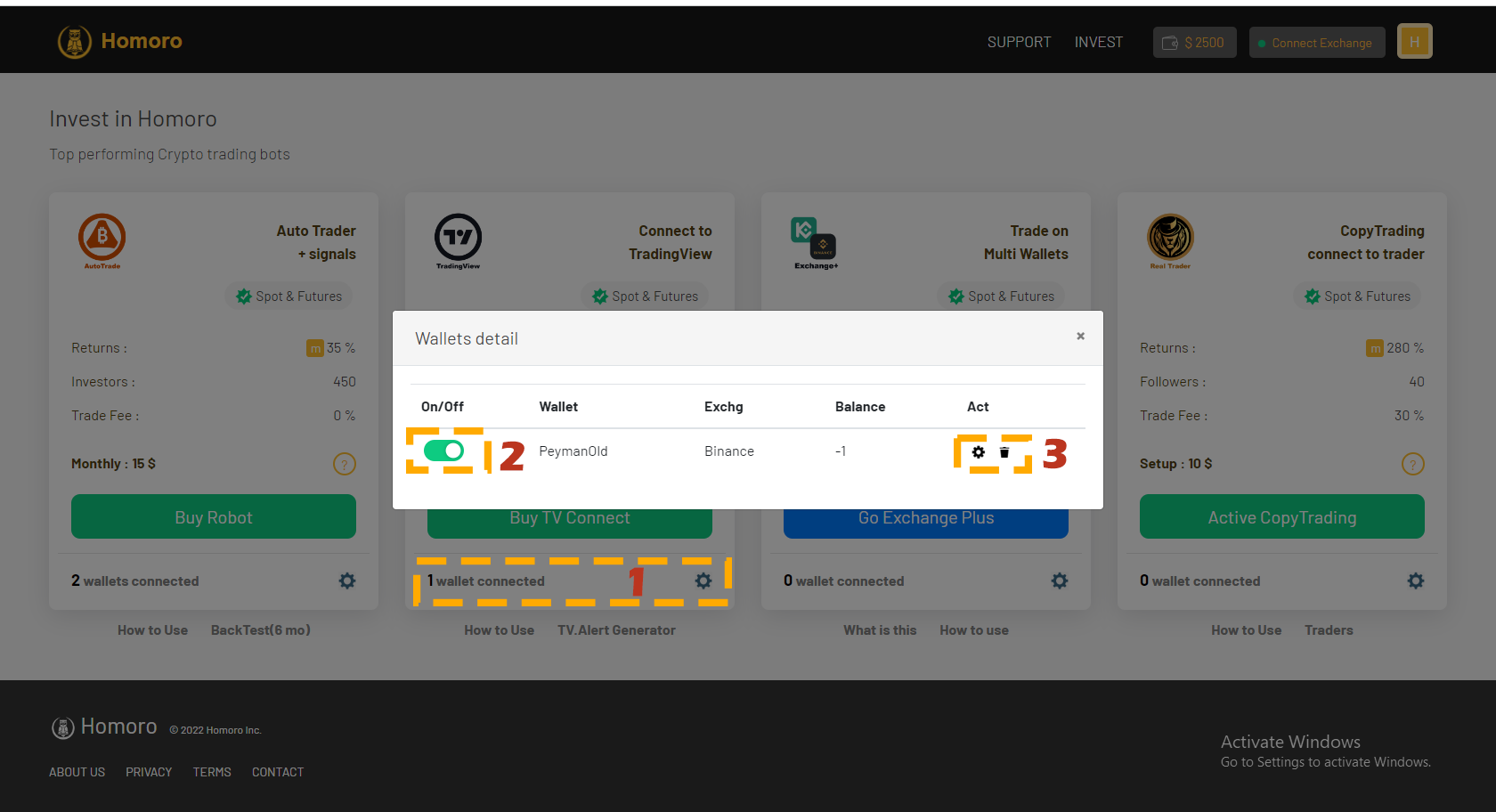

1 - after connect wallet to plan, click setting to open wallet list

2- on / off wallet ( on: connect / off: not connect )

3- click setting to view [ USERKEY ] for connection bitween homoro & tradingview Strategy

-

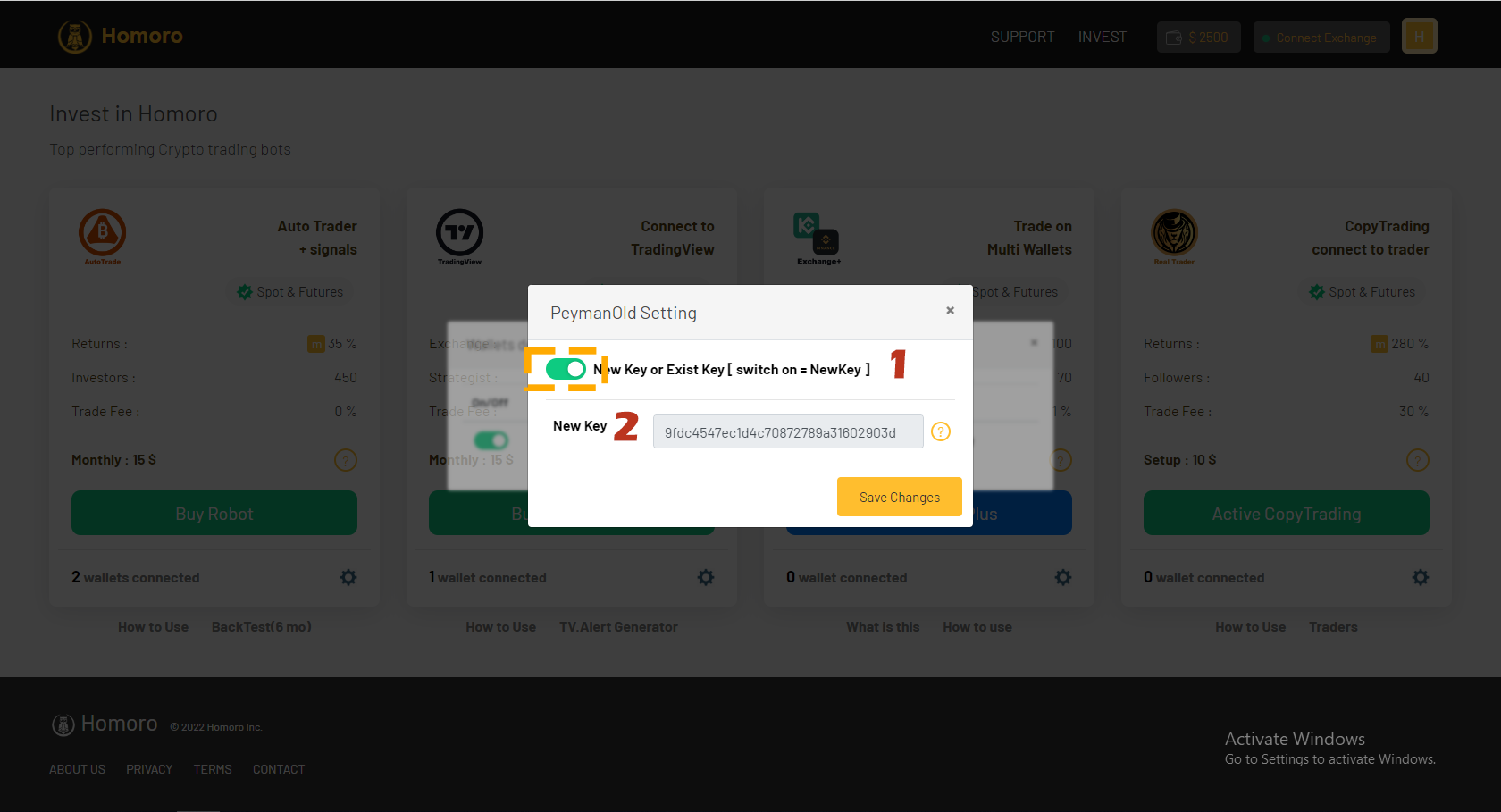

Step #2:

then click setting to Generate and view UserKey.

-

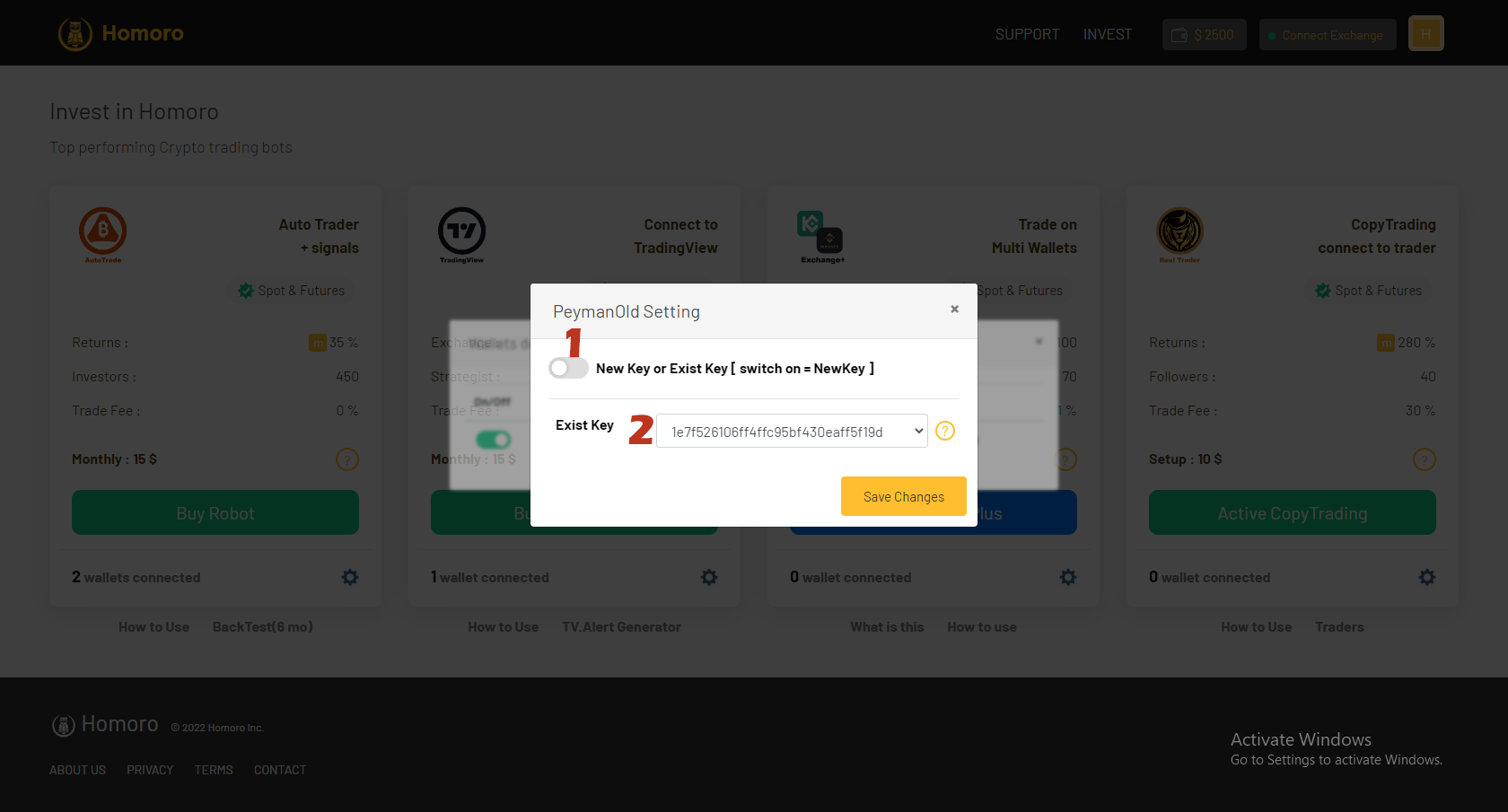

Step #3:

you can use [ new userkey ] for connect to one wallet or [ exist userkey ] for connect and trade to multi wallet with one trade.

Trading Command

-

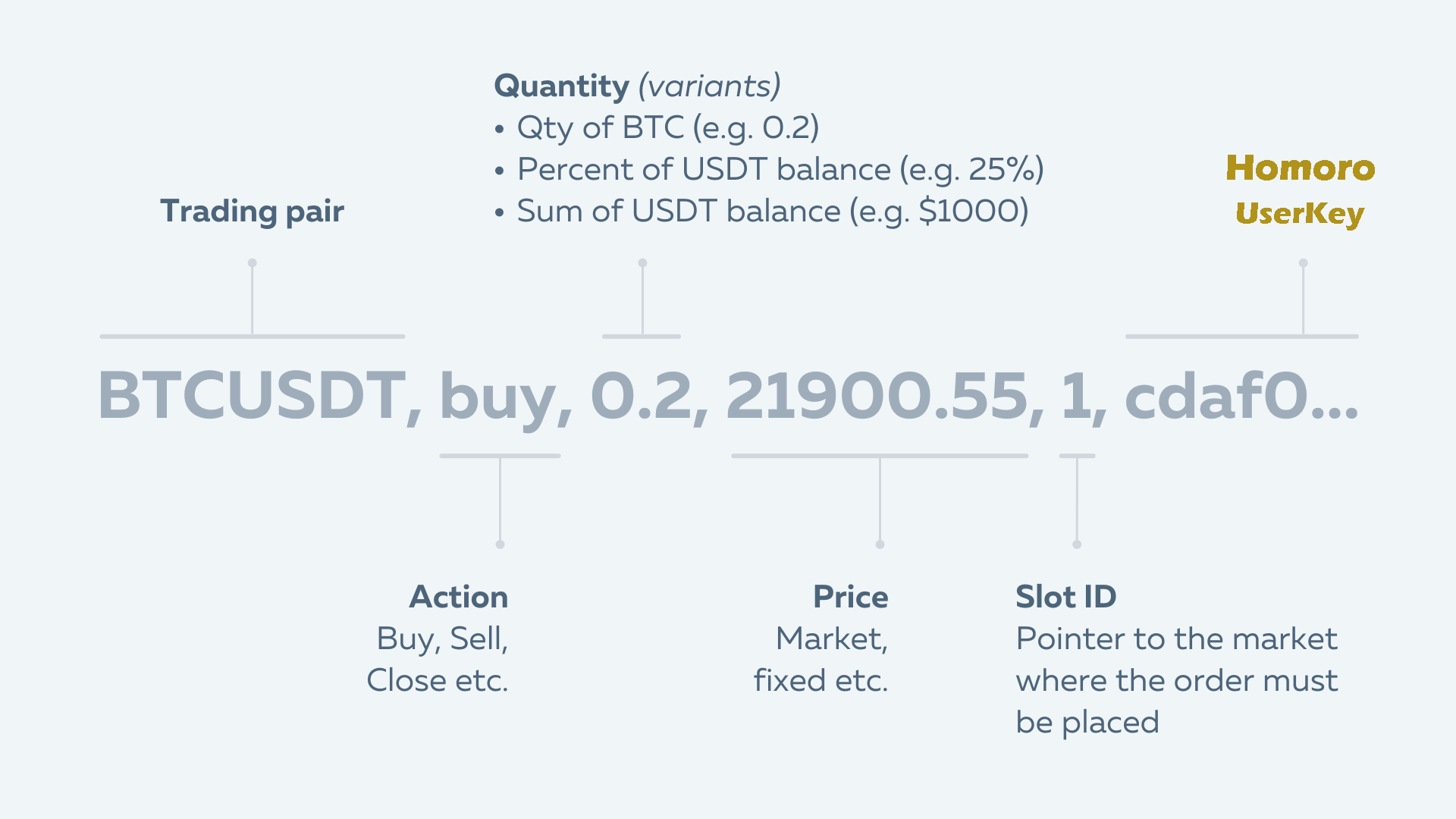

Trading command is the text line with few parameters. The order management process takes place through it. Such command must be used on the Message area while creating alerts on TradingView.

If current position is Long -or- there is no current position, then BTC will be bought for 10% of USDT balance (at market price). But if current position is Short, then size of such position will be reduced by 10%

Buy 0.1 BTC (at market price) and set Take Profit equal to 5%. Volume of TP order will be equal to Buy order (0.1 BTC)

. Close current position if any exists

. Sell BTC for 20% of USDT balance (at market price) using leverage equal to 5

. Set Take Profit equal to 5%

. Set Stop Loss equal to 1%

ETHUSDT, buy, 3.5, market, userkey

BTCUSDT, buy, 0.1, 21900(SM)(r), userkey

DODOUSDT

LUNA2BUSD

1000SHIBUSDT

1000XECUSDT

1000***USDT

1000***BUSD